Investment vehicles to invest in crypto assets have seen an exponential growth since a few years. Those vehicles provide a simple way of gaining access to crypto assets. Are all the investment vehicles available to invest in Crypto assets similar? What is the size of investor portfolios in crypto assets? What are the flows toward these products year to date with a special focus on October and November flows amidst market turmoil?

Are all investment vehicles available to invest in Crypto assets similar?

Due to the proliferation of products and the different regulations between US and Europe, there is some confusion about the different types of products. This confusion is today, and more than ever, relevant when some actors present ETNs of crypto-assets as ETFs. To date, the existing supply of crypto-assets in Europe is mainly made up of ETNs. There are no crypto-asset ETFs in Europe because regulators consider all crypto-assets as a single block, and it is therefore not possible to provide diversification by positioning on a basket of crypto-assets. The only existing ETFs are thematic ETFs based on a basket of equities linked to blockchain and crypto thematic. Additionally, since regulators does not consider crypto-assets as a currency, there cannot, for the moment, be Exchange Traded Currencies either. Existing vehicles include physically backed or synthetic crypto ETNs, Trust or Thematic equity ETFs as detailed in the last part of our article Crypto, to be or not to be an asset class.

What is the size of investor portfolios in crypto assets?

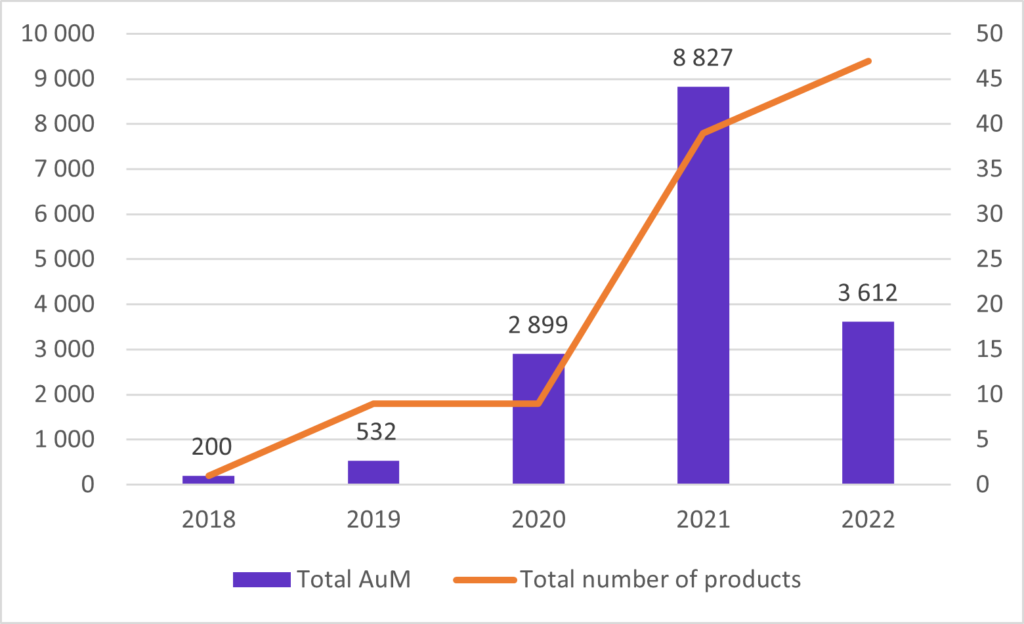

Worldwide, there are 228 crypto exchange-traded products (ETP) including ETF & ETN and trusts. Nearly half of these products 96 were launched in 2022, since the bitcoin bear market despite total assets dropping 70% to €23 billion in November 2022 from €74 billion in November 2021. The biggest part is currently under the trust vehicles which are securities listed on over the counter exchanges, with AuM of €16.1bn only available in the US.

In Europe, we count 94 crypto exchange-traded products (ETP) including ETN & Thematic ETF, ie 40% of total number of products worldwide. Total Assets amount to €3.6bn in November 2022, a 61% decline vs November 2021. This is yet, a very small part of the ETP assets as a whole in Europe ie below 1%. Thematic crypto ETF assets amount to a small part of the total with €455M of AuM.

Crypto ETNs covering a wide range of cryptocurrencies, including Bitcoin, Ethereum, Polkadot, Cardano, Solana, ….and indices of cryptocurrencies. This segment is dominated by new players unexisting in the traditional European ETF segment. Hashdex, a new issuer in Europe is the only one to offer access to an index of top crypto assets through the Hashdex Nasdaq Crypto Index Europe ETP. Yet old players also offer products on a basket of crypto assets, for example the WisdomTree Crypto Market ETP.

Equity Thematic ETFs have been issued on the blockchain and metaverse thematics. Invesco is one of the few traditional finance issuers to give access to both segments (ETFs and ETPs) through Invesco CoinShares Global Blockchain ETF since 2019 and Invesco Physical Bitcoin ETN (since the end of 2021).

Yearly AuM (€M) and number of European crypto investable products since 2018

What are the flows toward these products, year to date with a special focus on October and November flows?

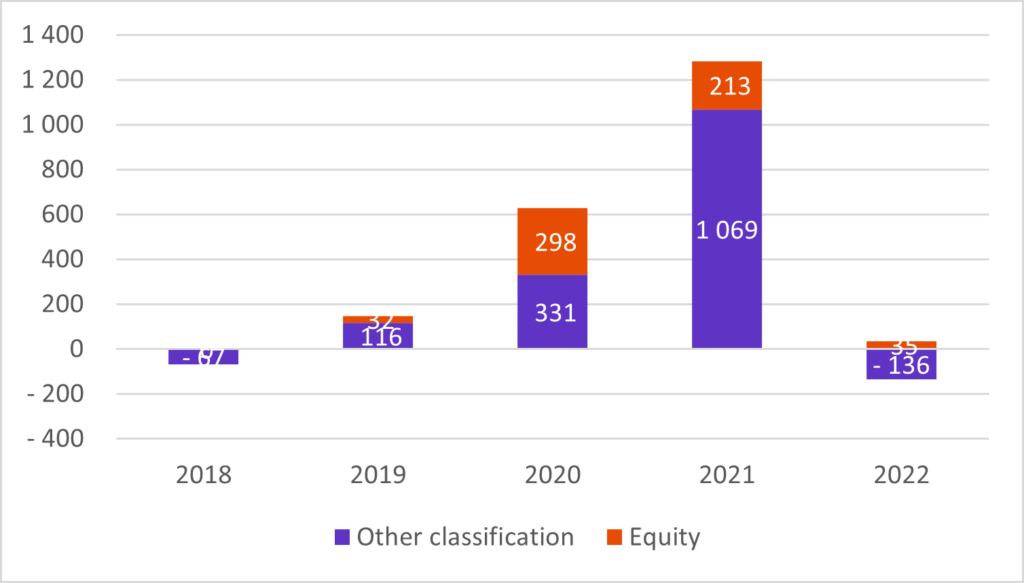

After exploding in 2020 and 2021, flows in 2022 are significantly down. Yet overall year to date flows toward crypto investable products in Europe are showing a slight decline of €102M after reaching €1.3bn in 2021. Interesting to notice that overall flows toward equity thematic ETFs are still positive year to date.

Yearly flows (€M) since 2018 toward European crypto investable products

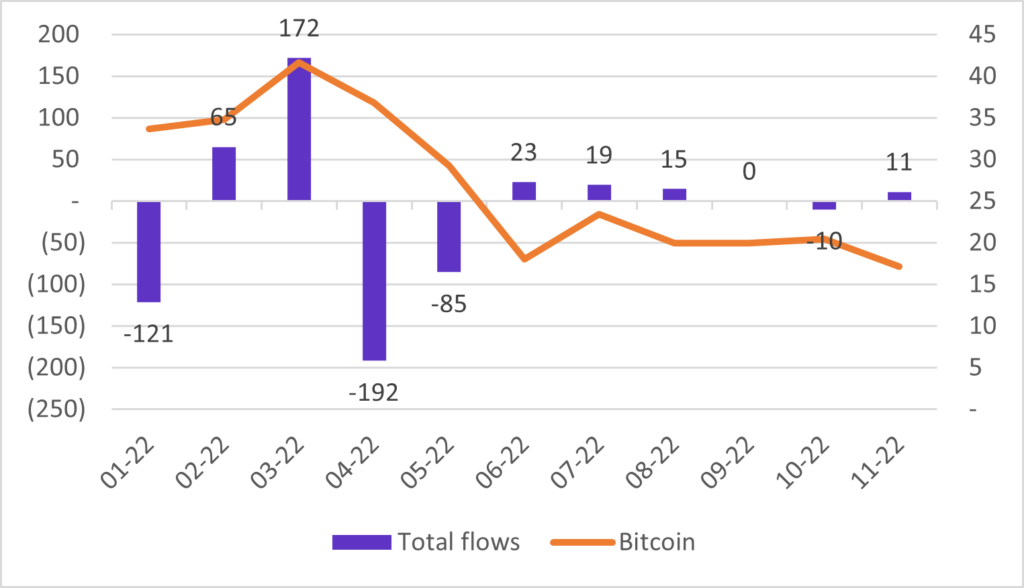

Also, worth noticing when looking in details at monthly flows, most of the outflows occurred in April and May and current market downturn did not have a major impact on flows with even slightly positive flows at the beginning of November 2022, as shown in the graph below.

Year to date monthly flows (€M) toward European crypto investable products

Current market fragility could be explained by the end of years of easing monetary policy and the recent cash scarcity, other reasons can be specific to and link to the fragility of the crypto ecosystem itself. The current crash, which has some hints of the subprime crisis, is even raising fears of important contagion effects. Yet even traditional asset classes experienced crashes, which at the end have proven to be beneficial in terms of regulations, liquidity management and processes.

As per our DNA, we are committed to give investors a fair view on the development of this hot market segment to help them build optimal portfolios.

To be followed…

Marlene Hassine Konqui & Ahmed Khelifa, CFA